Inventory Expansions testings

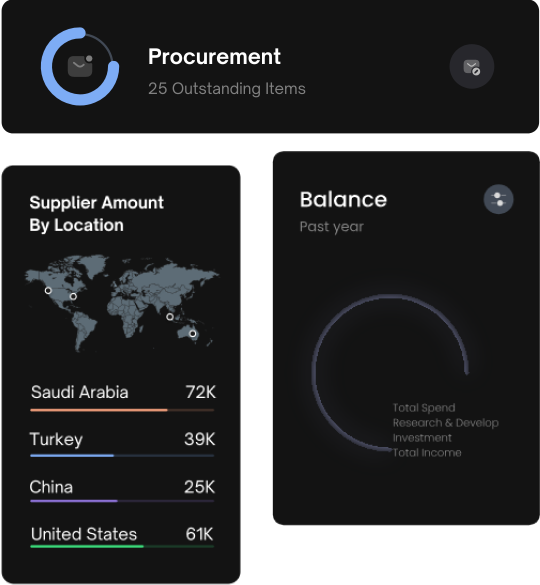

Expand inventory and diversify product offerings to meet customer demand.

Apply now for a decision in 60 seconds.

Up to SAR 4,000,000

Approval within 12 hours

Shariah compliant

Benefits

Apply now for a decision in 60 seconds.

Expand inventory and diversify product offerings to meet customer demand.

Invest in marketing and sales strategies to attract new customers and boost revenue.

Invest in marketing and sales strategies to attract new customers and boost revenue.

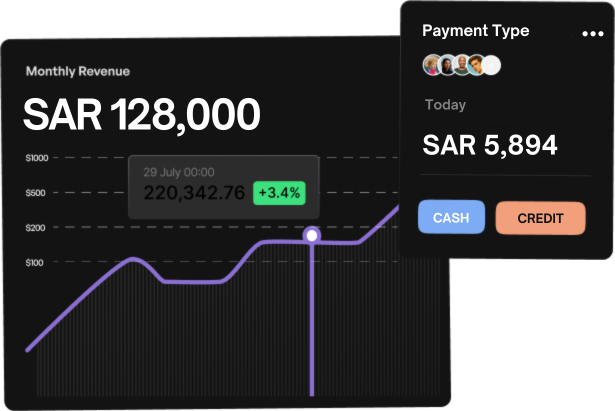

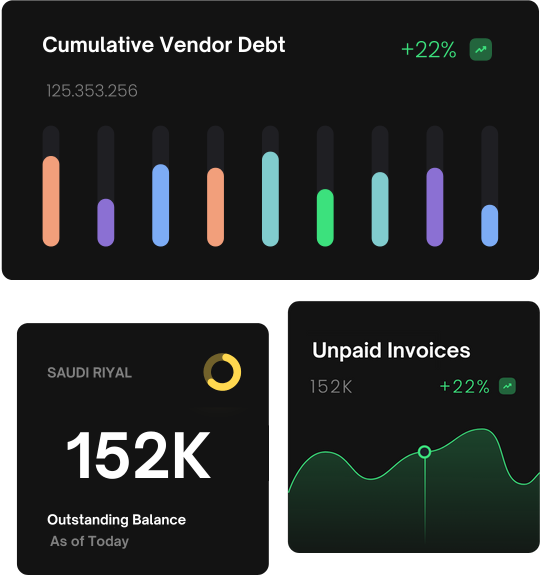

Manage cash flow effectively by settling outstanding debts or invoices and securing your supply chain.

Empower your point-of-sale (POS) business to reach new heights without the financial constraints testing.

Benefits

Facilitate immediate purchases, boosting sales, enhancing customer satisfaction, and improving cash flow with flexible payment options for businesses.

Funding Limit: Up to SAR 4,000,000

Approval within 48 hours

Financing period: from 6 months to 24 months

Competitive Sharia compliant Tanmeya testing

Our Products

Benefits

Facilitate immediate purchases, boosting sales, enhancing customer satisfaction, and improving cash flow with flexible payment options for businesses.

Financing ceiling: up to 250,000 SAR.

Financing duration: up to 12 months.

Competitive Profit Margin Percentage.

Shariah compliant.

Benefits

Facilitate immediate purchases, boosting sales, enhancing customer satisfaction, and improving cash flow with flexible payment options for businesses.

Financing ceiling: up to 250,000 SAR.

Financing duration: up to 12 months.

Competitive Profit Margin Percentage.

Shariah compliant.

HOW DOES IT WORK

Quick, simple, and efficient funding process

Complete the step in under 5 minutes with our streamlined application.

Fast review and approval of your application within 48 hours.

Funds are directly deposited into your bank account within 72 hours.

Finmal supports SMEs with quick, digital application processes, fast credit decisions, and competitive profit rates (Tanmeya).

“Finmal's flexible financing was crucial for our Jeddah-based retail business. With their help, we expanded our inventory and opened two more locations within a year. Their seamless process and understanding of SME needs have been invaluable to our growth.”

“Finmal's flexible financing was crucial for our Jeddah-based retail business. With their help, we expanded our inventory and opened two more locations within a year. Their seamless process and understanding of SME needs have been invaluable to our growth.”

“Finmal's flexible financing was crucial for our Jeddah-based retail business. With their help, we expanded our inventory and opened two more locations within a year. Their seamless process and understanding of SME needs have been invaluable to our growth.”

1. Needs Assessment

Identify Loan Type

Assess Loan Amount

Define Purpose (Clarify use of funds)

Consider Preferred Repayment Term

Evaluate Applicable Rates

2. Submit Application

Gather Documentation: ID & IBAN

Fill Business & Personal details

Choose Loan Terms

Submit Application

Review Application

3. Approval & Funding

Track Application Status

Respond to Inquiries if needed

Review Approval Terms

Accept offers

Access Funds

List of questions and answers our applicants typical ask.